Summary

Pricing sawlogs made available by the FCV involved two processes

- setting the total sawlog revenue, and

- setting individual royalties.

The Royalty Equation System (RES) was introduced for the latter component of pricing hardwood sawlogs in 1950, and is the main subject of this article. The evolution of pricing systems is covered in this separate article.

The RES was based on factors designed to ‘equalise’ the costs of selling sawn timber on nominated key markets by allowing for differences in the value of sawn timber produced from different logs, the costs of transporting logs from the forest to a nominated point for conversion, and transporting the sawn timber to the market. The calculation of royalties started with the Standard Mill Formula (SMF) which was the nominal mill door price for ‘scantling grade’ timber. This was adjusted to allow for the differences in the value of timber produced from different types of logs, and the transport costs of putting the timber on the assumed key markets. The ‘divergence’ factor in the equation estimated the difference in the value of timber produced from the types of logs from base of ‘scantling grade’. It involved estimating the proportion of the different grades of timber outturn, and the difference in value of the grades from ‘scantling grade’. The transport of sawn timber to the key market, mostly Melbourne, was adjusted by applying an allowance rate to the haulage distance from the point of royalty determination to the market. This produced an adjustment for the sawn timber volume which was then converted to log volume by multiplying by the sawn timber recovery rate. The log haul was then allowed for by considering the log haul distance over different road classes and applying a haul roading rate for each road class. Lastly a residue allowance was applied to provide for the revenue from selling the residues from sawmill processing. Other allowances were also applied for special circumstances where additional costs or reduced productivity occurred.

RES was designed for the circumstances of the time. It removed the cost disadvantage for sawmillers obtaining logs from remote forests. This encouraged the opening up of forests more distant from Melbourne to assist in supplying the large increase in demand for timber to support the post-World War II housing boom. The system was extended to apply to red gum and softwood sawlogs.

Background

The Royalty Equation System (RES) was used for pricing logs supplied by the FCV for more than four decades. The RES was resilient and long lasting. It was introduced in 1950, and was largely unchanged for more than three decades. The Victorian Government confirmed the application of RES in 1986 (TIS, 1986).

The aim of RES was to ‘equalise’ the cost of getting sawn timber to key markets to ensure royalties were equitable to sawmillers. The total of the royalty and transport costs of selling base grade sawn timber on defined key markets was to be the same for operations accessible to that market. The RES was not a full residual stumpage price. It did not appraise stumpage as a residual after all production costs had been subtracted.

Sawlog Royalties

Pricing sawlogs involved two processes:

- Setting the total sawlog royalty revenue from year to year, and

- Setting the individual royalty rates using the RES.

Absolute Level of Royalty

The absolute level of royalty was set by applying a simple percentage increase to the existing level. This percentage was determined in an annual review considering a number of factors including:

- Total costs estimated for the year ahead.

- Revenue factors such as maintenance of total revenue.

- Timber market factors including demand and prices.

- Royalties in other States.

The movement of these factors over the previous five years was reviewed to determine a percentage increase for the year ahead which would provide the desired revenue and relate to the prevailing market conditions. In earlier days, this figure was endorsed by the Minister of the day and applied. During the 1980’s, the percentage increases were set within the Government’s fee and charges guidelines, leading to increases generally below CPI increases. However, this approach had shortcomings. There was a need by licensees to have royalties set prior to the commencement of the financial year, which was well in advance of the Government setting the fees and charges guidelines. Also the market value of logs was more related to changes in sawn timber prices, and could be seen as a normal commercial product, rather than being considered a Government service. Sawn timber price movements were more volatile than Government fees and charges, which were generally less than the annual rate of inflation.

Royalty Equation System (RES)

The RES aimed to reflect the value of products that could be processed from a sawlog, and the cost of putting the sawn timber on the market. It achieved this by applying a complex equation. It was assumed that the total royalty bill should be distributed equitably between sawmillers. Licensees in more valuable forests close to market should pay higher royalty than those in remote and/or poorer quality forests.

The Base – Standard Mill Formula

Individual rates were built from a base royalty known as the Standard Mill Formula (SMF). This was the starting point for equalisation between sawmills. It was a notional mill door price for ‘scantling grade’ timber, including haulage costs, and was expressed as cents per cubic metre of sawn timber.

The SMF was used to apply the annual royalty increase by adjusting the SMF for the previous year by the increase for the current year. Hence, the SMF varied each year and was set at $84.53 per cubic metre green hardwood sawn timber in 1989 (Department of Conservation Forests and Lands, 1990).

Sawn Output from Hardwood Sawlogs

The SMF applied to ‘scantling grade’ timber. The quality and value of the sawn timber processed from a sawlog included timber grades of superior and inferior as well as ‘scantling grade’ timber. The divergence was the difference in the value of the parcel of sawn timber compared to ‘scantling grade’ timber.

The divergence was determined from information from sawmill studies of the recovery of sawn timber grades from parcels of different sawlog types. Each piece of sawn timber was graded and the proportion of each grade was determined for the total sawn volume. For example, consider a parcel of mixed species sawlogs that might have had a 50% recovery of sawn timber and might have a sawn output of:

- 20% special construction grade timber

- 65% scantling grade timber

- 15% inferior grade timber

The sawmill study information was converted to dollars on the basis of the relative prices of different grades of sawn timber. ‘Scantling grade’ was the assumed base grade and the divergence in price of the other grades is multiplied by their proportion outputs to calculate a divergence. For the above example, the divergence was calculated as follows:

Size Margins for Softwood Sawlogs

Softwood sawlogs were separated into size classes and there were royalty premiums for size classes above the minimum which were sawlogs of less than 20 cm CDUB (centre diameter under bark). There were two quality classes within each size class, sawlogs and veneer logs. Veneer logs attracted an 18% premium above the sawlog royalty for equivalent size class.

Costs of Putting Sawn Timber on the Market

These costs included:

- Harvesting costs

- Costs of hauling logs to the sawmill

- Costs of processing logs into sawn timber

- Costs of carting sawn timber to the market

The RES was not a full residual stumpage price and did not include harvesting or sawmill processing costs.

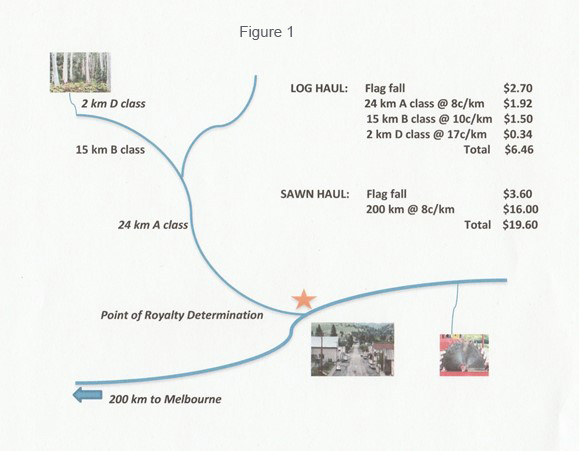

The costs of log haul to a nominal sawmill location, known as the Point of Royalty Determination (PRD), and cartage of sawn timber to the assumed market were estimated and subtracted from a base royalty. Marketing zones (described below) were defined forest supply areas with different assumed key markets.

Schedules of rates per kilometre were used to convert distances carted over various classes of roads to dollars.

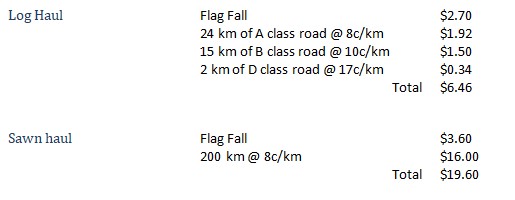

Consider the following example:

The calculation of the log haul and sawn haul allowances for the hypothetical example are shown in Figure 1.

Component for Sawmill Residue

It was assumed that 30% of the sawlog volume was not converted to sawn timber and was available for conversion to woodchips. This was the sawmill residue and was charged at an appropriate pulpwood royalty. Consider a hypothetical example: 30% of pulpwood royalty of $9.60 = $2.88

Calculation of Royalty Rates

Individual royalty rates for parcels of sawlogs were determined from the SMF by adding and subtracting for above factors. Log haul applied to log volume whereas the SMF, sawn haul and divergence applied to sawn timber volume. Hence, SMF, sawn haul and divergence were converted to log volume using the sawn recovery rate. Royalty would be calculated for the above hardwood hypothetical example as follows:

Royalty = (SMF + divergence – sawn haul)*recovery rate- log haul + residue = (84.53 – 5.85 – 19.60)* 50%/100 – 6.46 + 2.88 = $25.96.

Marketing Zones

There were five marketing zones for hardwood sawlogs other than red gum as follows:

- Zone 1 (Eastern & Central Zone) – Melbourne was the assumed key market and included all areas with sending stations within 211 km rail distance from Melbourne on the western, northern and north eastern railway lines, and all areas served by the Gippsland railway line other than zones 4 and 5.

- Zone 2 (South Western Zone) and Zone 3 (North Eastern Zone) – all areas of the State excluded from zones 1, 4 and 5. The key market in each case was the railway station to which road transport allowance from the forest was least.

- Zone 4 (East of Cann River) - key market at Eden, New South Wales.

- Zone 5 - in the Bendoc-Bonang locality with key market at Bombala, New South Wales.

Two zones were recognised for red gum

- Melbourne Supply Zone – all logging areas with logical sending stations on the Melbourne – Koodrook line, on the Melbourne – Wahgunyah line or in the area enclosed between those lines and the Murray River, and elsewhere within 211 rail km rail of Melbourne. The key market is Melbourne.

- All other logging areas with the key market at the railway station to which road transport allowance is least.

Other Variations

Certain further deductions to allow for special disadvantages or costs were applied. Thinning allowance could be made for operations in hardwood regrowth where special care was needed in felling and extraction to protect the retained stems. A residual logging allowance may be made in areas that were considered ‘cut out’ and the stands carried very low merchantable volume. When Sirex damaged trees occur in softwood plantations, a special reduction may be made in recognition of extra costs associated with ensuring against spread of the wasp.

Changes to the RES

The RES was only significantly changed twice in addition to the extension to include red gum and softwood logs since 1950. It was amended in 1984 following review in the previous year (Forests Advisory Committee, 1983). This amendment involved updating the equation factors and did not change the basic structure of the equation.

Substantial amendment occurred in 1990 (Department Conservation and Environment, 1991) to the RES for hardwood and softwood logs on the back of initiatives announced in the Government’s Timber Industry Strategy (TIS, 1986). The reviews that led to the changes included extensive public participation processes.

Significant changes had been implemented to the management of hardwood forests for timber production under the Timber Industry Strategy which necessitated changes to the RES. An important change with regard to log pricing involved the introduction of a log grading system and the allocation of logs of different species and grades to licensees based on their capacity to value-add the processing of the logs. Differences in sawlog quality were reflected in royalty by the application of standard recovery rates and output grades for different combinations of species, grades, size class and Forest Management Area group. The standard recoveries and output grades were developed from analysis of data from extensive sawmill studies at the time.

Other changes to the hardwood RES included:

- Royalty was charged on a gross log volume avoiding the need for defect allowance for the purpose of log pricing.

- The application of a charge for residues was simplified.

- The divergence schedule was revised.

- A reduction in the SMF was introduced for lower quality logs (D grade logs).

- The PRD concept was changed to accommodate new log allocation arrangements announced in the TIS

- A revised log haul schedule was developed.

- Royalty zones were simplified and made more precise.

- The key market concept and the sawn haul factor were removed from most areas.

- A roading differential factor was introduced to reflect broad difference across the State in the costs of building and maintaining forest roads

- Annual increase in royalty was implemented by raising all rates by the approved percentage increases to ensure that relativities were not eroded by inflation.

Changes to the softwood RES included:

- A new schedule of size classes and price margins similar to the South Australian system was based on discussions with licensees

- Royalty was charged on gross volume

- Central PRD’s were chosen based on the same guidelines to those for choosing hardwood PRD's

- Log haul and sawn haul schedules were revised

- Royalty zones were reviewed

- A roading differential was introduced

- Minimum royalty rates were such that sawlog royalty did not fall below pulpwood levels.

The RES was the basis of log prices for softwood logs until 1993 at the time of the establishment of the Government owned plantation enterprise, Victorian Plantations Corporation (VPC). Log pricing was then based on individual negotiations rather than a uniform price increase being applied to all customers. The RES was no longer used but the price differences that were inherent at the time were generally maintained, at least initially. A significant change under VPC was that arrangements moved from stumpage to mill door sales which negated the ‘royalty’ concept.

RES ceased being applied to hardwood logs with the establishment of VicForests in 2004. Full market pricing was introduced for existing supply agreements and an auction system was applied for uncommitted logs. VicForests also moved to mill door sales.

Conclusion

The RES was an administered partial residual pricing system. It was ‘fit for purpose’ in achieving the primary objective at the time of supporting the opening up of forests more distant from Melbourne by removing the disadvantages of higher costs associated with transporting logs and sawn timber form distant forests. This was to provide for the large increase in demand for timber, particularly structural timber, to support the post-World War II housing boom. This was also at a time when forests closer to Melbourne had been destroyed by the 1939 bushfires. These forests had been the major source of timber to the Melbourne market.

However, the RES failed to seek to establish and incorporate a market price for sawlogs. Nor did it reflect the basic commercial nature of the Government’s commercial enterprise or seek to ensure revenue at least met the cost of producing the logs. These shortcomings became more important over time and led to calls for reviewing the royalty system. Major reviews occurred in 1983 (Forests Advisory Committee, 1983) and 1985 (Timber Industry Inquiry, 1985). The main changes resulting from these reviews were expressed in the Government’s Timber Industry Strategy in 1986 (TIS, 1986). The changes involved the retention of the ‘equalisation’ principles of RES and required the pricing system to reflect the commercial basis of the enterprise. Timber production was to ensure at least four per cent return on funds invested and apply commercial accounting standards to timber production. This was to ensure the State received a commercial return on funds invested in timber production. This was achieved by amendments to the royalty systems in 1990 (DCFL, 1990) and 1991 (DCE, 1991).

References

A Review of Royalty Systems to Price Wood from Victorian State Forests. Report to the Minister for Economic Development, Government of Victoria.Forests Advisory Committee, 1983

FCV Annual Report 1919-20

Forest Royalties and the Royalty System. Royal Commission on State Forests and Timber Reserves. The Tenth Progress Report 1900

Report on the State Forests of Victoria. Ribbentrop, B 1896

Report of State Forests Department for year ended 30th June 1918.

Report of the Board of Inquiry into the Timber Industry. Timber Industry Inquiry, 1985

Review of the Softwood Royalty Equation System. Description of the New System. Department of Conservation and Environment, 1991b

Royalty Equation System Review. Discussion Paper. Department of Conservation Forest and Lands, January 1990

Timber Industry Strategy, 1986

The Royalty System for Pricing Sawlogs from Victorian State Forests, Department of Conservation and Environment, 1991a